Illicit drug trade is highly lucrative and a short cut route to acquire wealth and affluence overnight. It was easy to make money, but difficult to move the funds to their destination. The drug traffickers had to face major problems in transaction of the drug proceeds. There were very few banks to take the risk, though there are instances of banks involvement in monetary transactions of drug money. The dealers had to explore some ways for the movement of cash. Therefore, innumerable channels were explored and created by drug syndicates. Their unorganised but systematic method of monetary transaction is popularly known as money laundering.

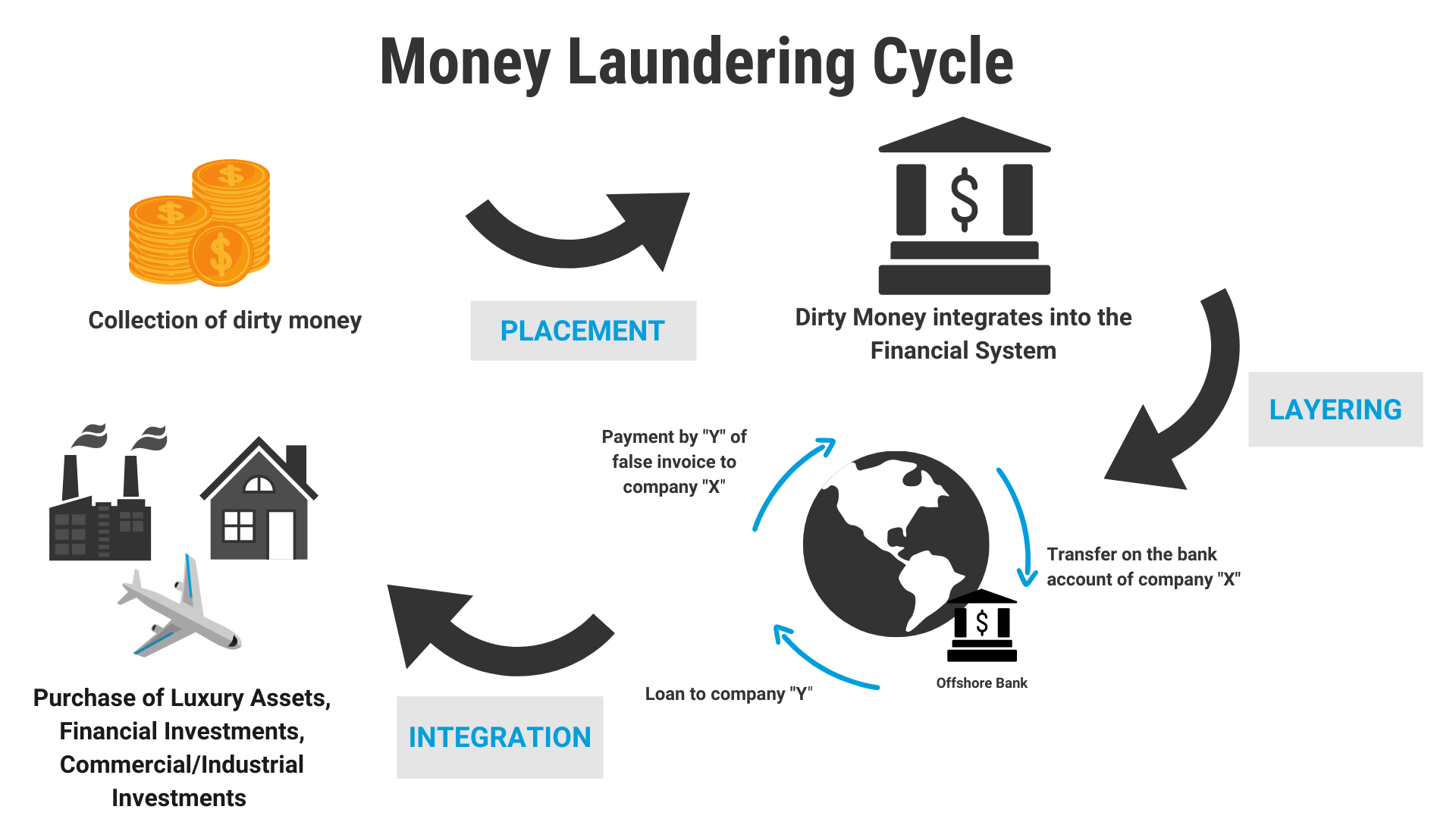

Money laundering is defined as use of money derived from illegal activity by concealing the identity of the individuals who obtained money and converts it to assets that appear to have come from a legitimate source. The large sum generated from narcotic drugs has become part of the international monetary system. It plays an important role in the corporate sector and international monetary market. The black money is used to influence politics and economy. This money can buy politicians, fund elections, topple an elected government, take over business enterprises and destabilise an established politico-economic system.

The cash accumulated from narcotic drugs trafficking is laundered into licit money through investments in foreign banks, real estate, hotels, transport and entertainment business. More than banks, private financial institutions have helped drug barons to manage their finances. Switzerland, Hong Kong, India, Pakistan, Afghanistan and Thailand are among the important countries involved in money laundering activities in an organised fashion. Banking laws and lavish life style of the elite facilitates covert operations and monetary transactions of drug traffickers.

The best instances of money laundering through legitimate financial institutions is the case of Bank of Credit and Commerce International (BCCI) and Pakistan’s Habib Bank. The BCCI’s involvement in money laundering was to such an extent that it was nicknamed Bank of Crooks and Criminals. Founded by a Pakistani banker-Aga Hassan Abedi in 1972 in Luxembourg, BCCI had business interests in 70 countries and assets worth 20 billion US dollars by the 1980s. This bank was initially financed by Sheikh Zayed bin Al Nahayan of Abu Dhabi. Abedi fiddled with an idea of a bank for developing countries or a ‘Third World’s Bank’ for publicity. His vision carried many developing countries. Even Bank of America had an investment of US dollars 2.5 million in BCCI. Within ten years the bank had grown to a considerable size. But voluminous monetary transactions by BCCI raised doubts about its clients and modus operandi. The Bank of America withdrew its investment in 1986 apprehending its drug connection. Many cases of drug profits gradually surfaced. Latin American drug cartels and drug syndicates of South East and South West Asian regions were the main clients of BCCI. They approached the BCCI with drug proceeds without any hesitation. The managers of the bank namely Muesella, Awann, Bilgrami, Akbar, Baaksa, Naqvi and others welcomed the leaders of the syndicates. The Pakistanis dominated this bank. Finally their narcotic drugs laundering drama came to an end in 1991 when the US Grand Jury indicted the managers and others involved in the transaction for fraud and racketeering.

These two cases are explicit examples of illicit monetary transactions through legal channels. There are several other ways to launder drug proceeds through professional smugglers and gangsters. Many of these criminals deal only in narcotic drugs and run a parallel government to manage their global network. These groups are well organised and are popularly known as ‘drug syndicates’. They launder the drug proceeds through various means such as:-

- Bank Deposits and Loans or ‘Smurfing’

- Double Invoicing

- Investment in Foreign Business

- Investment in Real Estate

- Travel and currency exchange Agencies

- Hawala Transactions

- Currency Smuggling

- Conversion of Cash in Kind,

- Gambling Joints

- Tax Havens (VDS etc.)

Needless to highlight that South West Asia especially India, Pakistan and Afghanistan offer vast opportunity for money laundering. It is a known fact that the real estate boom in India during the 1980s and early 1990s was because of unprecedented investment in property business by Daud Ibrahim (currently in Pakistan) and his associates. Similar was the case of the entertainment industry in Mumbai, Daud Ibrahim & Co. emerged as the real financier for films and the music industry during this time. His gang dominated the money market for ten years by funding such business enterprises in Mumbai. The unholy alliance of drug smugglers, criminals, builders, film producers and petty business enterprises came to light only after the Bombay Blasts in 1993. Until then no one that knew that illicit drug proceeds had already converted into legitimate business and government could do nothing about it as there was no document or paper, a prerequisite for legal action against the crime committed.